What is the Future of Fintech Startup?

What is Fintech?

The Fintech Startup industry uses technology to provide simpler financial services to customers, including banking, lending, investing, and more. Fintech services enable businesses to obtain a variety of other payment methods including credit cards, debit cards and digital wallets. They also tend to come with lower transaction fees compared to traditional payment processors, which can reduce your overhead in the long run.

Fintech provides you with real-time financial data and insights that help you make better decisions for your business. The software can automatically categorize transactions and create financial reports, which reduces the risk of errors in your bookkeeping. AI-powered customer service tools, like chatbots, can improve the customer experience by providing immediate responses to customer inquiries and support requests.

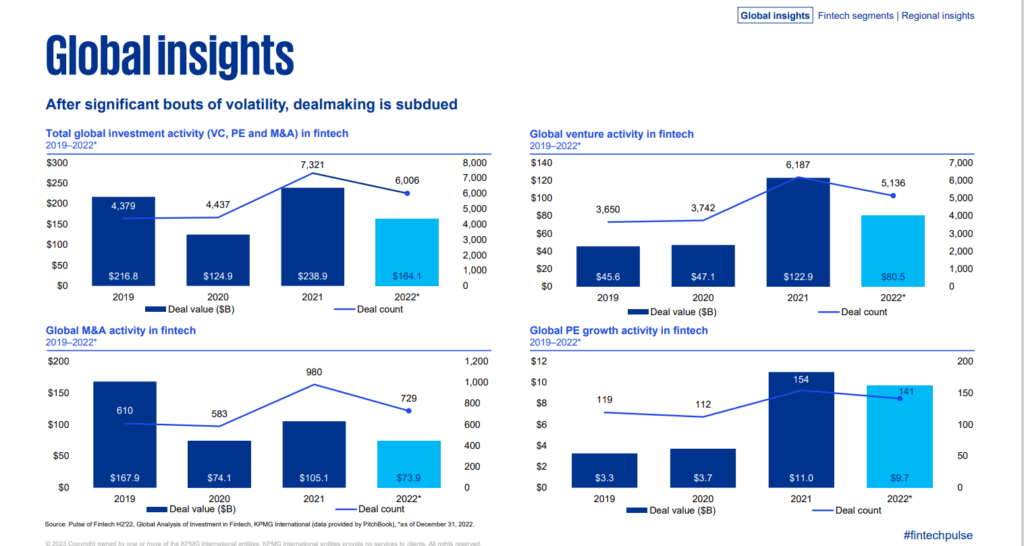

Investment Fintech Startup Globally on 2022

Following 2021’s record high level of total global fintech investment ($238.9 billion) and deal volume (7,321), 2022 saw both total investment and deal volume fall — to $164.1 billion and 6,006, respectively (falls 68.7%). While low by comparison, it was the third best year for fintech investment ever and the second best year for deal volume.

Anton Ruddenklau, Global Fintech Leader at KPMG International

“While global fintech investment dropped in 2022 – particularly in the second half of the year as large M&A transactions dried up – it can’t be characterized as a bad year by any means. Total investment was still the third highest ever, while the number of fintech deals came second only to 2021’s record high. 2022 was a particularly excellent year for regtech, with investment growing quite significantly year-over-year.”

Investment Fintech Startup in UK on 2022

After a very strong 2021, with total fintech investment in the UK reaching £32.46 billion ($35.5 billion), 2022 saw a decline of 56% to £14.42 billion ($15.8 billion). 593 UK M&A fintech, Private Equity (PE), and Venture Capital (VC) deals were completed this year, down from 724 in 2021. due to rapidly changing market conditions, higher interest rates and inflation, and downward pressure on valuation will ultimately result in a decline in total investment into UK fintech by 2022.

Also, in Berlin, total funding for 2021 reached $3.2 billion, and in 2022, decreasing 46.9%, and the total funding was only $1.5 billion.

Investment Fintech Startup in US on 2022

While fintech investment in the Americas dropped from $108.9 billion in 2021 to $68.6 billion in 2022, the region saw the second highest level of annual deal volume ever (2,786) after 2021 (3,316 deals) (falls 63%). Both fintech investment and deal volume dropped considerably from H1’22 to H2’22 — from $41.6 billion across 1,760 deals to $26.9 billion across 1,026 deals. The largest deals of H2’22 included three buyouts in the US: the $8.4 billion buyout of tax compliance company Avalara, the $1.7 buyout of B2B-focused order-to-cash solutions firm Billtrust and the $1.6 billion buyout of regtech provider Computer Services Inc.

However, Robert Ruark, says

We’re seeing an increasing willingness among fintech investors in the Americas to invest in seed and early stage VC deals, and significantly less funding going into later stage deals — particularly pre-IPO deals — because of the lack of opportunity in the IPO markets right now. That doesn’t look like it’s going to change quickly as we head into 2023. With the expectation that interest rates will keep rising as we head into H1’22, we’ll continue to see pressure on the valuations for later stage firms. As valuations decline, we may see strong M&A activity in the second half of 2023.

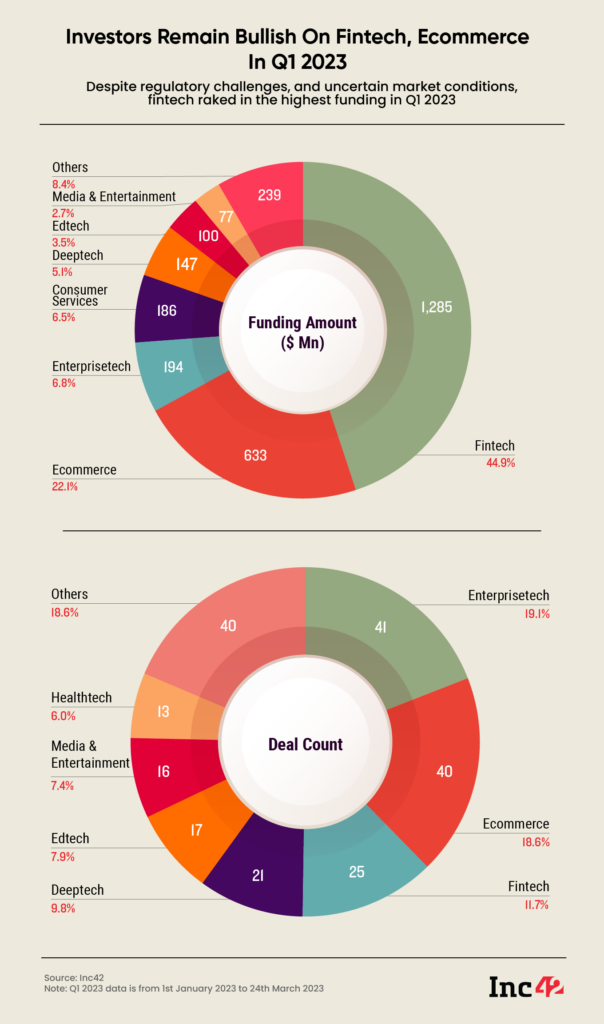

Investment for Fintech Startup Firms on 2023

With over 4,000 startups, the fintech sector alone raised $1.28 Billion in Q1 2023, followed by the e-commerce segment. E-commerce startups raised $633 million during the quarter, while technology companies came in a distant third with $194 million in funding.

While fintech startups received the highest amount of funding, the enterprise tech and e-commerce sectors overtook fintech in terms of the number of deals, with 41 and 40, respectively, during the quarter. At 25, fintech funding deals accounted for only 11.7% of total deals during the March quarter.

Why Invest in Fintech Startup Firms?

- Mondu Investor Andrew McCormack, Founding Partner of Valar Ventures, says, “We strongly believe in Mondu’s ability to become a leader in B2B payments innovation. Last year the company demonstrated incredible growth not only in its product offering and customer base but also in terms of organizational maturity. We want to accelerate the execution of their vision further as Mondu continues to build a platform of B2B payments solutions to serve a variety of industries.”

- Entrepreneur First, on their blog, said: “Blocktorch is building the observability platform for the decentralized stack. With Blocktorch, engineers can access metrics, logs, and traces across blockchains in one place. In less than six months, the team has launched a public alpha version running on two chains. More than 100 engineers have signed up within seven days, and partnerships with leading web3 infrastructure providers have been agreed upon, which will give the team access to over 150,000 potential users.”

Conclusion

Fintech holds and handles almost all the technology startups that allow it to grow, with digital payment services being the most prominent among fintech developments. As we can see from all Fintech Companies, they experience growth in a very short time.

Finally, the role of Fintech in growth markets is very significant and is a combination of funding, business models, and supporting infrastructure in the form of regulation and education that will form the basis for this growth. Even total funding in 2022 will decrease, as stated by Anton Ruddenklau, Global Fintech Leader at KPMG International.

So, do you think Fintech will Grow better in the Future?